Canada and USA

Investors Are Suing Al Haymon’s Backers – Here’s What You Need To Know

In late April, news broke of a lawsuit against Waddell & Reed, the mutual fund reportedly shooting close to $1 billion into Al Haymon’s PBC franchise, calling the venture “potentially criminal.”

“Unbeknownst to investors, starting in or about April 2013, the Trustees permitted and approved purchases…of approximately $925 million of private securities in a start-up and potentially criminal company in the field of professional boxing promotion,” the complaint states, arguing that the investment “violated the stated terms” of the funds’ investment criteria.

“Investing nearly a billion dollars of private securities in a start-up boxing promotion company, as high-risk a venture as one could imagine, meets none of these criteria.”

A piece on a SB Nation MMA blog suggested the $925 million investment “collectively lost over $567 million in a little less than three years.” Of course, any basic understanding of equity markets would label such a claim…a stretch, at best.

For starters, the PBC investment “represents less than 1% of [the funds’] holdings,” said Roger Hoadley, a VP at Waddell & Reed and Ivy Investments, a related fund. “Lawsuits such as this often arise when the value of a fund has declined.”

The net total of the fund’s assets under management are highlighted in the chart here.

According to the complaint, by the time of the investments, the total cash infusion into the PBC represented even less than 1% of total holdings, at about a 0.68%—in other words, a drop in the ocean.

Yet, when news broke in February of W&D’s big Q4 losses, the boxing public went up in arms, all but administering last rites to the PBC, citing the aforementioned losses and dips in generous purses, a trademark of Haymon’s.

Meanwhile rival promoters have spoken out, both legally and publicly.

“He’s turning this into a sports property?” Main Events boss Kathy Duva said in October. Once Haymon closed the time-buy deal with NBC, Duva lost both a platform and stream of income from the network. “I think the end game is simply to bilk investors.”

Yes, the Waddell & Reed mutual fund has been facing a steady decline since peaking at $6.42 billion market cap—i.e. market value—on April 1, 2014, capping an explosive six-month growth spurt that saw W&D gain $2 billion in market value.

In reality, however, the stock value has tapered off consistently since then. As of May 11, the stock [WDR] had a market cap of $1.6 billion, a $700M plunge from the $2.32 billion it had to kick off the year.

But so has pretty much the whole stock market, a trend spurred by a number of factors—none of them boxing related.

In fact, some of the biggest financial institutions took big L’s during this period, caused in large part by global market volatility (mainly China), a Q1 stock market downturn and an oil crisis.

“Heightened market volatility has been a consistent theme throughout 2015, challenging performance and causing anxiety with investors,” W&D chairman and CEO Hank Herrmann said in February.

Golden Boy and Top Rank each filed nine-figure lawsuits against Haymon for antitrust violations and, well, basically having more money, with Top Rank naming W&D as a co-defendant. (The antitrust claim was dismissed last October, letting the mutual fund off the hook.)

But for whatever it’s worth, Yahoo Sports’ Chris Mannix reported last week that a settlement could be on the way with Haymon as well.

“Scheduled depositions have been postponed indefinitely, multiple sources told Yahoo Sports—strong indications the two sides are moving toward a settlement,” Mannix wrote.

Whatever happens next, two things remain pretty certain:

1) the lawsuit against W&D will likely get thrown out; and if it doesn’t, it won’t affect the PBC. At least not directly.

2) promoters’ lawsuits against Haymon won’t affect W&D. At least not directly.

In other words, business as usual on both fronts.

In fact, if the whole situation wasn’t bizarre enough already, here’s a (somehow) likely fallout from the whole legal skirmish.

“Details of any settlement talks are unknown,” Mannix wrote, “but multiple people involved in the lawsuit told Yahoo Sports of one possible outcome of a settlement: a rematch between Floyd Mayweather and Manny Pacquiao.”

With IVs, shoulder injuries and saltwater, brace yourself for more lawsuits ahead.

Based in Brooklyn, TV and radio sportscaster Philip Michael is the executive editor of thesweetscience.com and boxingchannel.tv. A former director at business pub Bisnow Media, Philip also runs a boutique investment company on Wall Street.

-

Featured Articles3 weeks ago

Featured Articles3 weeks agoThe Hauser Report: Cinematic and Literary Notes

-

Featured Articles4 weeks ago

Featured Articles4 weeks agoOscar Duarte and Regis Prograis Prevail on an Action-Packed Fight Card in Chicago

-

Book Review3 weeks ago

Book Review3 weeks agoMark Kriegel’s New Book About Mike Tyson is a Must-Read

-

Featured Articles1 week ago

Featured Articles1 week agoThe Hauser Report: Debunking Two Myths and Other Notes

-

Featured Articles2 weeks ago

Featured Articles2 weeks agoMoses Itauma Continues his Rapid Rise; Steamrolls Dillian Whyte in Riyadh

-

Featured Articles4 weeks ago

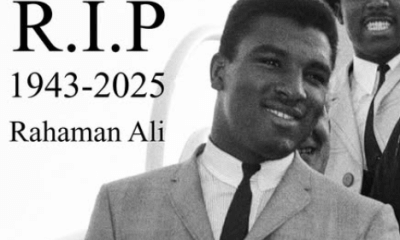

Featured Articles4 weeks agoRahaman Ali (1943-2025)

-

Featured Articles4 weeks ago

Featured Articles4 weeks agoTop Rank Boxing is in Limbo, but that Hasn’t Benched Robert Garcia’s Up-and-Comers

-

Featured Articles3 weeks ago

Featured Articles3 weeks agoKotari and Urakawa – Two Fatalities on the Same Card in Japan: Boxing’s Darkest Day